42+ is mortgage insurance tax deductible 2022

Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or. Web When filing your income taxes you must choose either the standard deduction or itemized deductions not both.

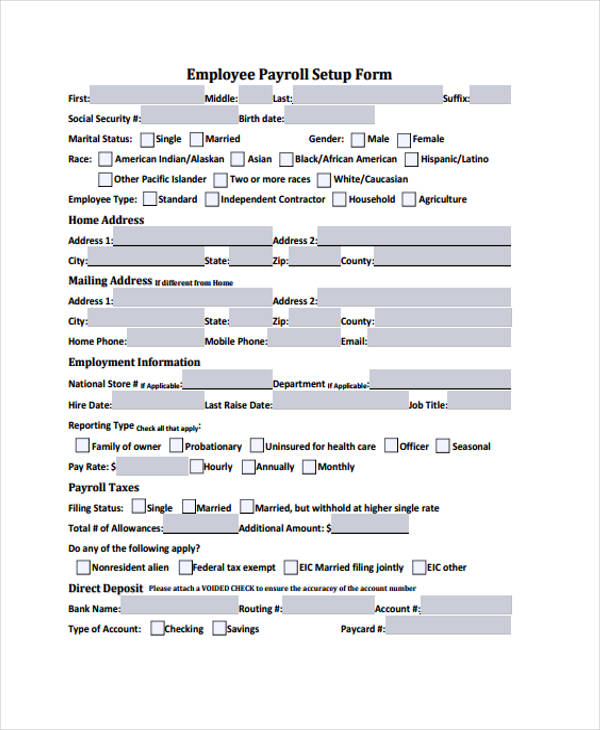

Free 42 Sample Payroll Forms In Pdf Excel Ms Word

See here for.

. Here are the standard deductions for the. However you may be able to claim a deduction for mortgage insurance. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. This deduction is expired so you cannot use it on your. Discover Helpful Information And Resources On Taxes From AARP.

Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are. Mortgage interest Many US. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Learn more on the IRS site. 109000 54500 if married filing separately The mortgage. Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022.

This income limit applies to single head of. The PMI tax deduction works for home purchases and for refinances. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

However higher limitations 1 million 500000 if married. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you decide. Web Eligible W-2 employees need to itemize to deduct work expenses.

Web The limit falls to 750000 375000 for single and separate filers if you bought the home after this date. Web Homeowners insurance isnt normally tax-deductible with some exceptions. Interest paid on a home equity loan may be tax-deductible if used for IRS-approved reasons.

Boost your health savings account. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses.

Homeowners can deduct what they paid in mortgage interest when they file their taxes. Home equity loan interest deduction. Prior tax years Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or.

Web Starting in tax year 2022 the Schedule A deduction for Mortgage insurance premiums has expired and can no longer be entered into the tax return. Web 17 hours agoCollectively annual spousal IRA deposits cant exceed joint taxable income or two times the yearly IRA limit. Web The PMI Deduction will not been extended to tax year 2022.

Web 5 tax deductions for homeowners 1. Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Of property taxes in combination with state and local income or sales taxes. For tax year 2022 those amounts are rising. Web Here are the standard deduction numbers for 2022.

If you took out. Web Up to 96 cash back 100000 50000 if married filing separately Eliminated if your AGI is more than one of these. 12950 for single and married filing separate taxpayers.

Web The mortgage insurance premium deduction was a temporary part of the tax code beginning in 2006. Web No generally you cant claim a deduction for personal mortgage insurance premiums. The standard deduction is 19400 for those filing as head.

Web Is mortgage interest tax deductible. Below are the standard deductions for the 2022 tax year. Web 1 day agoMarch 23 2023 410 PM CBS News.

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

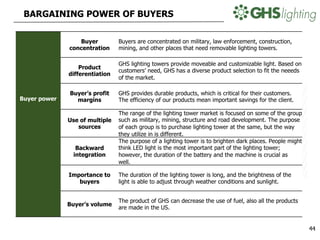

Mes Business Strategy

Pdf Policy Responses To Low Fertility How Effective Are They

Free 10 Mileage Log Samples In Pdf

Mes Business Strategy

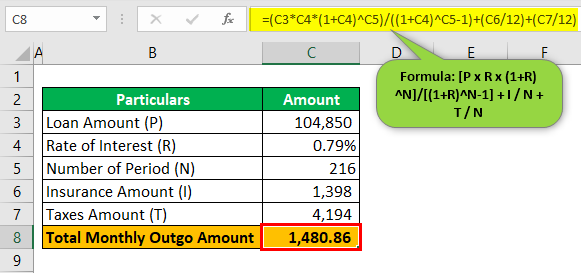

Mortgage Payment Calculator With Taxes Insurance Examples

Is There A Mortgage Insurance Premium Tax Deduction

Milton Herald February 3 2022 By Appen Media Group Issuu

Free 42 Sample Payroll Forms In Pdf Excel Ms Word

Flats For Sale In Shiraswadi Under 30 Lakhs 42 Properties Below 30 Lakhs In Shiraswadi

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

Mes Business Strategy

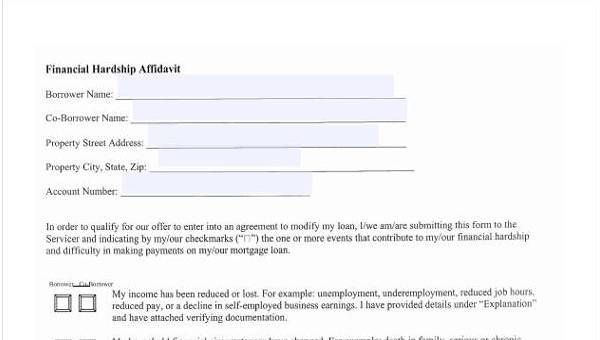

Free 42 Affidavit Forms In Pdf

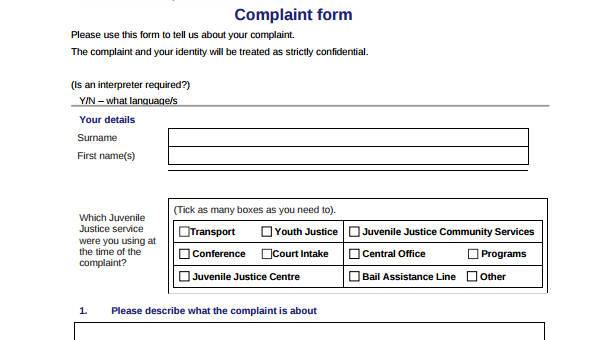

Free 42 Complaint Forms In Pdf Ms Word Excel

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

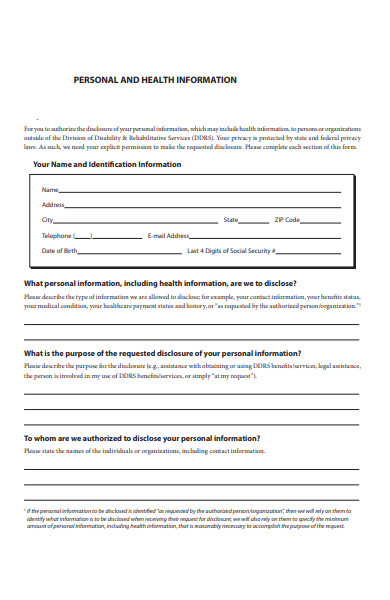

Free 42 Personal Forms In Pdf Ms Word Excel

Some Important Tips Your Should Know Before Buying Term Plan